UK growth forecast to peak next year before slowing again

Getty Images

Getty ImagesThe UK’s economy will grow slightly faster than expected this year and next, but the pace of growth will then ease, according to the government’s official forecaster.

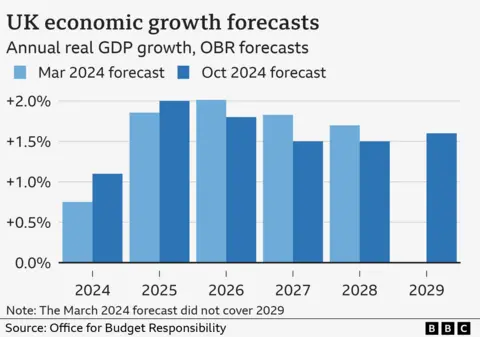

The Office for Budget Responsibility (OBR) predicted the economy would grow by 1.1% this year and 2% in 2025.

But from 2026, growth is predicted to be weaker than previously forecast, slowing to 1.5% by 2028.

The OBR said the policies in the Budget would “temporarily boost” the economy in the short term, but leave the size of the economy “largely unchanged in five years”.

Chancellor Rachel Reeves said the Budget would mark “an end to short-termism”.

“Every Budget I deliver will be focused on our mission to grow the economy,” she said.

The government has pinned its reputation on boosting growth, arguing that a new approach to investment would underpin a better economic performance and “more pounds in people’s pockets”.

However, while the OBR’s short-term expectation for growth was higher than its March forecast, the outlook for later in the parliament was downgraded from the earlier set of predictions.

“The OBR pointed to a short-term sugar rush, as a result of the debt-financed spending splurge, but that turns into a modestly negative impact by the end of the parliament,” Paul Johnson, head of the Institute for Fiscal Studies, an independent economics think tank, said in a note.

The OBR said in the longer term investment, planning reform and greater economic stability should help to boost growth, “in a sustainable way” he said, but not until 2032.

It is hard it to make precise predictions several years ahead, and economic forecasts are regularly updated.

The combination of stronger growth early in the parliament, followed by weaker growth in later years, suggests the cumulative impact, or the size of the economy by the end of the parliament, will not be very different overall.

In total the economy is set to grow by nearly 8.2% in total by 2028. In March it was forecast to grow by nearly 8.5%.

However, Paul Johnson, head of the independent economics think tank the Institute for Fiscal Studies, described the growth forecast as “pretty disappointing stuff”.

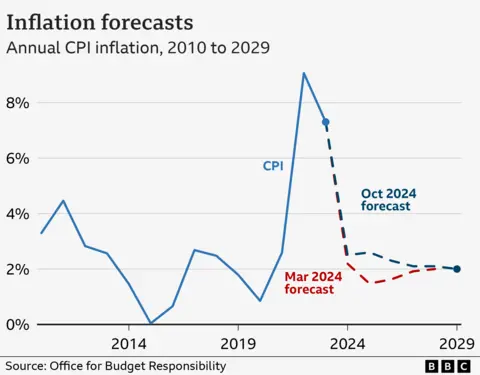

Measures in the Budget would increase demand this year and next year, which was likely to keep inflation and interest rates higher, resulting in slower growth in later years, he told the BBC.

The OBR expects inflation to remain slightly above the Bank of England’s 2% target until 2029.

How much the economy grows is a key factor limiting what the government will be able to do over the course of the parliament.

If growth is strong, tax revenues are likely to increase, meaning there is more to spend on public services, or on reducing taxes, and to pay the interest on government borrowing. If growth is weak, the government is likely to have to cut back on what it would like to do.

Reeves said while there would be no return to austerity, there would “still be hard decisions to come”.

But she said the OBR believed Labour’s plans would have a positive impact on the “supply capacity of the economy” or its ability to grow.

The government bases its policy plans on the forecast of the OBR. However, economic forecasting is not an exact science.

Predictions can be affected by a huge range of factors including geopolitical risk, global energy prices, and events in the world’s other large economies. Small changes in any of these factors can have an impact on the path of UK growth.

Reeves said she would “catalyse £70bn of investment” in the UK through a new National Wealth fund, transform planning rules to “get Britain building”.

She said she would work with devolved governments in Wales, Scotland and Northern Ireland, as well as regional mayors, to boost local and regional growth plans.